RML secures strategic investment from Tribeca Investment Partners

Our US critical minerals Investment Resolution Minerals (ASX: RML) just raised $2M via a strategic investment with Tribeca Investment Partners.

Tribeca is a global fund with a focus on the natural resources sector, and we have done relatively well in companies where Tribeca have also invested, including:

- Locksley Resources which is up ~416% from our Initial Entry Price.

- Rapid Critical Metals which is up 83% from our Initial Entry Price.

- American West Metals which is up 118% from our Initial Entry Price.

- Advance Metals which is up 140% from our Initial Entry Price (Tribeca came into this one at a higher price then us).

Tribeca are coming into RML at 8c per share - which is a premium to the last raise price for RML.

One thing we noticed in the announcement was that RML would use the funds to “explore downstream critical mineral processing initiatives”.

(Source)

As well as the “identification and acquisition of additional strategic assets”:

(Source)

We are looking forward to seeing what comes from this, because we have seen how Tribeca’s involvement in downstream partnerships can work for our other Investment Locksley Resources (ASX: LKY).

Tribeca came onto LKY as a strategic advisor to specifically advise on “advice on downstream processing, technology collaborations, government engagement, funding programs and product development initiatives specifically related to critical minerals projects and advanced material application”.

(Source)

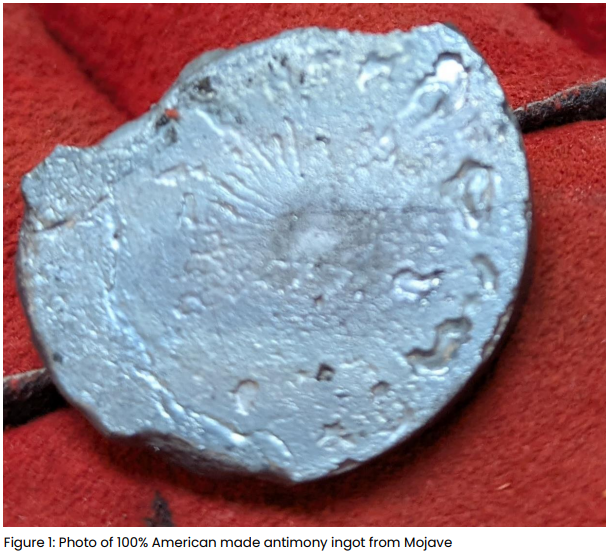

LKY then did a deal with Rice University to develop antimony processing tech using environmentally friendly, non-toxic Deep Eutectic Solvent technology.

And today, LKY produced the first US sourced, US processed antimony ingot (we covered that in a note this morning).

(Source: LKY announcement)

Hopefully, with Tribeca involved, RML can develop a coherent downstream strategy too.

What’s next for RML?

🔄 Drilling results

RML said prior that the first phase of drilling had been completed and that results will be released as soon as they become available.

(Source)

🔄 Complete NASDAQ listing

RML has hired Roth Capital to support with a US NASDAQ listing.

🔲 Maiden Resource Estimate

RML is targeting a gold resource by 2026 using the holes from this drill campaign.

RML already has a non-JORC resource estimate of 261,000 ounces of gold at Golden Gate at 0.93g/t.

🔲 Sampling and metwork programs

RML will undertake column leach met testing on Golden Gate core samples as well as met testing on the tungsten ore picked up from the mill stockpile.